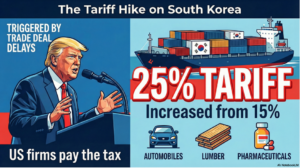

US–South Korea trade tensions have sharply escalated as the United States raises tariffs on South Korean imports from 15% to 25%, marking a decisive shift toward a more aggressive and transactional global trade strategy. The move underscores Washington’s growing reliance on tariff diplomacy as a primary foreign-policy tool, with significant implications for markets, supply chains, and alliance reliability.

US–South Korea Trade Tensions and the Tariff Escalation

The latest tariff hike targets automobiles, pharmaceuticals, lumber, and all goods classified under “Reciprocal TARIFFS.” US officials argue that South Korea failed to move swiftly enough to approve a bilateral trade agreement finalized in October, despite Washington reducing barriers on its side.

By framing legislative pace as a breach of commitment, the administration has effectively linked market access to domestic political timelines, signaling a tougher enforcement model in US trade policy.

Strategic Impact on Industry and Supply Chains

The US–South Korea trade tensions place immediate pressure on American firms deeply embedded in Korean supply chains. Since tariffs are paid by importers, US automotive and pharmaceutical companies now face a direct 25% cost increase, squeezing margins and increasing downstream price risks.

Analysts warn that this approach forces domestic industry to absorb the economic burden of diplomatic leverage, raising reputational and financial concerns for US manufacturers dependent on Korean components.

Market Volatility and Diplomatic Fallout

Financial markets reacted swiftly. The KOSPI index initially dropped before rebounding, reflecting heightened uncertainty and the emergence of a diplomatic risk premium for exporters tied to US demand.

Seoul has entered crisis-mode diplomacy. Industry Minister Kim Jung-kwan is accelerating travel plans to Washington to seek urgent talks with US Commerce Secretary Howard Lutnick, after South Korea said it received no formal notice of the tariff move.

Trade Deal Timeline at the Center of the Dispute

The roots of the standoff lie in differing interpretations of implementation speed:

-

October: Trade agreement reached; South Korea pledges $350 billion in US investment, including shipbuilding.

-

November: US begins reducing selected tariffs.

-

November 26: Deal submitted to South Korea’s National Assembly.

-

February (expected): Parliamentary approval projected after winter recess.

Washington views the review process as delay, while Seoul considers it standard democratic procedure—an imbalance now driving policy escalation.

Global Pattern of Tariff Diplomacy

The South Korea dispute fits a broader pattern. Similar tariff pressure has been applied in recent standoffs involving Canada, China, and NATO-aligned countries, reinforcing concerns that even close allies are no longer insulated from unilateral trade shocks.

Experts say the erosion of counterparty reliability could undermine long-term planning and weaken the “friend-shoring” model that underpins modern supply chains.